how much does illinois tax on paychecks

How to Change a Name on a Mutual Fund Account 2. If your spouse does not live in Illinois you can ask for a legal separation in the county where you live.

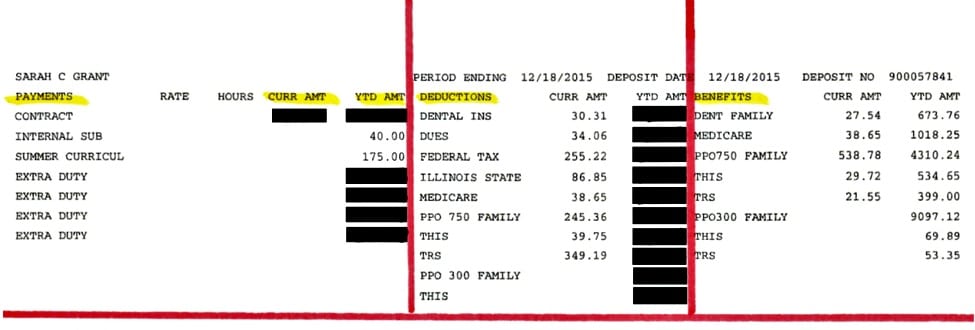

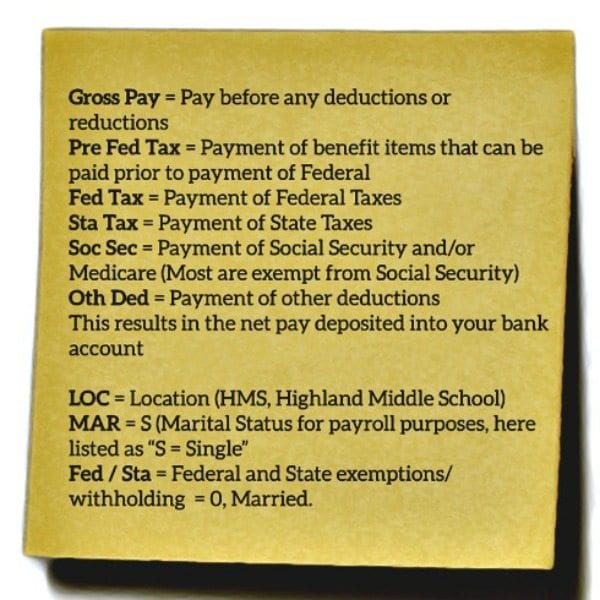

Understanding Your Teacher Paycheck We Are Teachers

Its capped at 25.

. Hello and thanks for your comment. One example of a regressive tax is the Social Security tax a type of payroll tax that everyone needs to pay on their first 147000 of income in 2022 up from 142800 in 2021. Explains how child support is calculated in Illinois.

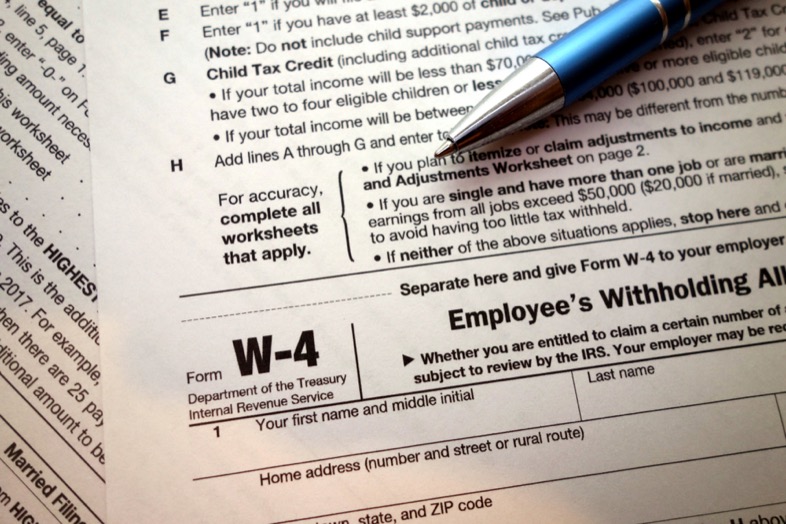

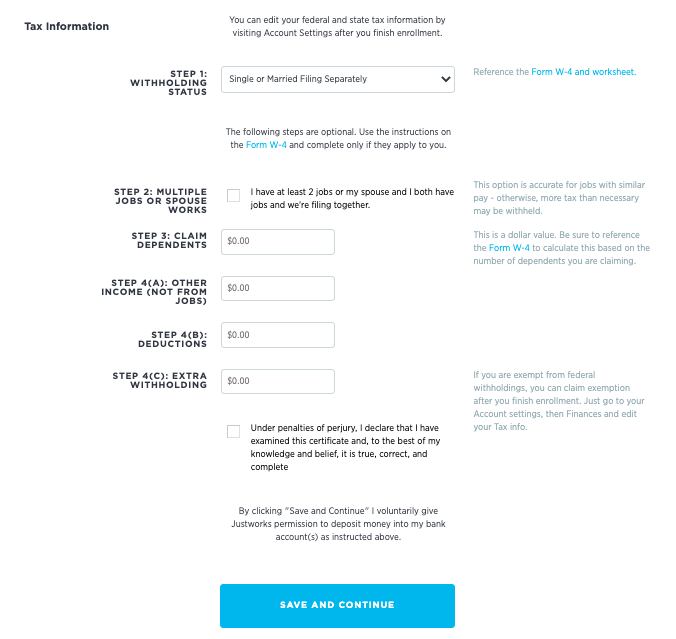

For State of Illinois tax inquiries please visit the State Tax Commission website or contact them by phone Toll free at 1-800-732-8866. The frequency of your paychecks will affect their size. Your employer figures out how much to withhold from each of your paychecks for federal income taxes based on the information you provide on your Form W-4.

Do I Have to Pay Federal Taxes If They Were Not. 1 The higher your income goes above that limit the lower the. How many income tax brackets are there in Puerto Rico.

Nevada has the 13th highest combined average state and local sales tax rate in the US according to the Tax Foundation. Once a due date has passed the IRS will typically dock 05 of the entire amount you owe. But the state makes up for this with a higher-than-average sales tax.

Nevada State Sales Tax. What does the tax underpayment penalty for quarterly taxes work. Form NDW-R Ohio Department of Taxation.

Federal income tax is usually the largest tax deduction from gross pay on a paycheck. Do I still need to file a tax return. North Dakota Office of State Tax Commissioner.

The Tax Foundation puts the states total tax burden at 98 percent making it the 24th most affordable state the least of any state with no income tax and behind other areas that do charge the. Use this form to let the other parents employer know to withhold child support from paychecks. It is levied by the Internal Service Revenue IRS in order to raise revenue for the US.

Will they still use my paychecks as an income for him. The collection of income taxes occurs throughout the year by withholding money from a persons paychecks. Its also called the Income Withholding Order IWO.

REV-419 Employees Nonwithholding Application Certificate Virginia Tax. Monday Friday 800 am. The more paychecks you get each year the smaller each paycheck is assuming the same salary.

Submitted by Karla Baldwin on Tue 03092021 - 1122. ILAOs tax identification number is 20-2917133. Describes the formula a judge uses and how they might depart from the formula.

My employer has deducted taxes from my paychecks. ILAOs tax identification number is 20. How much you pay in federal income taxes depends on several factors including your salary your marital status and whether you elect to have additional tax withheld from your paycheck.

Employees Statement of Residency in a Reciprocity State Pennsylvania Department of Revenue. Some people get monthly paychecks 12 per year while some are paid twice a month on set dates 24 paychecks per year and others are paid bi-weekly 26 paychecks per year. Tax system is based on self-reporting of income.

The income tax system in Puerto Rico has 5 different tax brackets. Not all 1099s are created equally and there are several different kinds of. You probably wont receive a tax refund if you never paid any taxes on your 1099 income but its sometimes possible.

While individual income is only one source of revenue for the IRS out of a handful such as income tax on corporations payroll tax and estate tax. The general sales tax rate in Nevada is 685 percent statewide but it does vary by county as some impose a local sales tax as well. At the end of the year every person that earned income must file a tax return to determine whether the government collected enough taxes through withholding or whether the government owes a person a refund for paying too much tax.

Penalties include interest which can change every quarter. Reciprocity West Virginia State Tax Department. This income tax calculator can help estimate your average income tax rate and your salary after tax.

5 Ways to Derail Your Loan Approval 3. The individual income tax rate in Puerto Rico is progressive and ranges from 0 to 33 depending on your income. For each partial or full month you dont pay the tax in full the penalty increases.

Illinois Paycheck Calculator Smartasset

Taxes 5 1 Taxes And Your Paycheck Payroll Taxes Based On Earnings Paid To Government By You And Employer Income Taxes You Pay On Income You Receive Ppt Download

Illinois Paycheck Calculator Smartasset

New W 4 Irs Tax Form How It Affects You Mybanktracker

Payroll Software Solution For Illinois Small Business

New Tax Law Take Home Pay Calculator For 75 000 Salary

2022 Federal State Payroll Tax Rates For Employers

Questions About My Paycheck Justworks Help Center

Bigger Paychecks In 2022 With Expanded Tax Bracket Ranges And A Larger Standard Deduction Aving To Invest

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Understanding Your Teacher Paycheck We Are Teachers

Understanding Your Teacher Paycheck We Are Teachers

Understanding Your Pay Statement Office Of Human Resources

Paycheck Calculator Take Home Pay Calculator

Final Paycheck Laws By State Findlaw

Here S How Much Money You Take Home From A 75 000 Salary

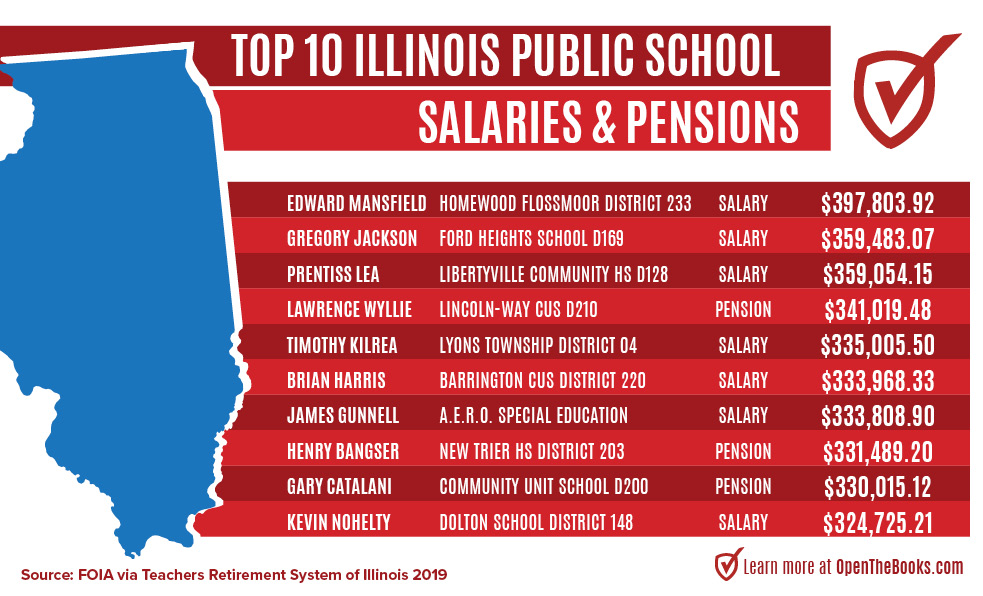

Forbes Why Illinois Is In Trouble 109 881 Public Employees With More Than 100 000 Paychecks Cost Taxpayers 14b Charts News Open The Books